1100 Lake Street, Suite 120, Oak Park, IL 60301

Oak Park | 708-848-3159

DuPage County | 630-852-9700 Mokena | 815-727-6144

Contact Our Firm

The use of the Internet or this form for communication with the firm or any individual member of the firm does not establish an attorney-client relationship. Confidential or time-sensitive information should not be sent through this form.

I have read and understand the Disclaimer and Privacy Policy.

Oak Park Tax Issues in Divorce Lawyer

Attorneys for Tax Strategy During Divorce in Chicago, Maybrook, and Cook County

The end of your marriage represents a massive shift in nearly every aspect of your life, and you will want to be sure you have set yourself up for success after your divorce is complete. One key area that should not be overlooked is how the decisions made during the divorce process will affect your taxes. Determining your best tax strategies can be especially complicated if you have a high net worth, and in these cases, you will need an experienced attorney on your side to help you manage the avalanche of legal and financial concerns that may arise.

At Wakenight & Associates, P.C., we are well-versed in the tax issues that divorcing spouses must address, and we can put our more than 95 years of combined experience to work for you. We will aggressively advocate for your interests throughout the legal process, ensuring that you will have the financial resources to meet your needs following the finalization of your divorce.

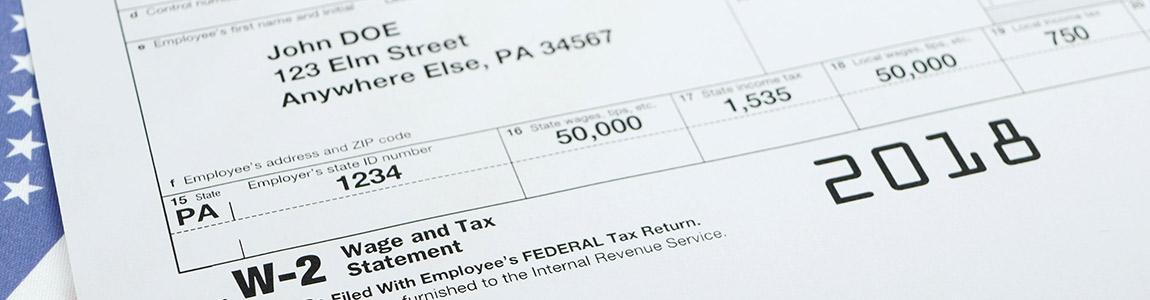

Tax Considerations to Address During Divorce

You may be able to realize some tax savings during your divorce if you are able to work together with your ex-spouse to determine a mutually beneficial tax strategy. This may include continuing to file tax returns jointly for the previous year, which is an option if your divorce is still pending or if the divorce was finalized on or after January 1 of the current year. This type of arrangement may not be possible in a high conflict divorce, but regardless of the situation, it is best to work with a financial expert to determine the best approach to take when filing taxes. An accountant can also help you understand tax issues such as:

- Capital gains - Transfers of property between spouses during the process of asset division are not subject to taxes. However, if you choose to sell any high-value assets, such as real estate property, these transactions may be subject to capital gains taxes.

- Retirement and investment accounts - If you and your spouse are dividing assets such as 401(k) or IRA accounts, you should be aware that the early withdrawal of funds from these accounts can result in penalties or taxes. In order to avoid this, a Qualified Domestic Relations Order (QDRO) should be used to make these transfers.

- Dependents and exemptions - Depending on the decisions made about child custody, your divorce settlement should specify which spouse is allowed to claim children as dependents or make use of child tax credits. You will also likely need to update your income tax withholdings to reflect this arrangement.

- Support payments - For divorces finalized on or after January 1, 2019, both child support and spousal maintenance are not considered taxable income for the recipient, and they are not tax-deductible for the payor. Spouses should be sure to understand how these payments will affect their taxes, as well as the tax implications of any future divorce decree modifications.

Contact a Skokie Divorce Attorney

Resolving financial issues during divorce can be a complex matter, and understanding the role that taxes play in this process can make things even more confusing. Our attorneys will make sure you understand the full implications of the decisions made during your divorce, and we will advocate for your financial interests throughout the legal process. To schedule a free consultation, contact us at 708-480-9651. We assist with high asset divorces in Oak Park, Chicago, Maybrook, Riverside, Cicero, Forest Park, Berwyn, River Forest, Skokie, Elmwood Park, and Cook County.